The stock market plays an important role in the financial system. Millions of Indians invest in the stock market every year, hoping to earn good returns on their investments. However, investing in stocks can be tricky, as stock prices do not always reflect the true value or worth of a company.

Read on to understand the relationship between stock prices and company valuation in the Indian context.

What drives stock prices?

Stock prices are driven by the forces of supply and demand. When more investors want to buy a stock than sell it, the share price tends to rise. When more investors want to sell the stock than buy it, the share price falls. Stock prices can change rapidly based on news, investor sentiments, earnings reports, economic conditions, and other factors that impact the demand for a stock.

Many factors unrelated to the company's fundamentals and intrinsic value can cause its share price to fluctuate. For example, high inflation might cause investors to sell stocks, driving down prices across the market. Or an optimistic economic forecast could spur a surge of buying activity, lifting prices. These forces impact all stocks, regardless of the actual performance or valuation of the underlying companies.

Understanding company valuation

To determine the true worth or valuation of a company, analysts examine financial metrics like:

- Earnings per share (EPS)

- Price-to-earnings (P/E) ratio

- Return on equity (ROE)

- Profit margins

- Sales and revenue growth

- Total assets and liabilities

- Cash flow

By studying the company's financial statements and operations, analysts gain insight into its overall financial health and growth prospects. A company's valuation reflects analysts' estimates of its ability to generate profits and free cash flow now and in the future. The intrinsic value of a stock is based on the company's expected future cash flows, discounted back to the present.

Differences between price and value

Often, a company's stock price differs from its intrinsic valuation. Shares may trade above or below what the company is really worth.

Reasons for mispricing include:

- Investor overreaction – After opening a demat account, many investors may get overexcited about a company's prospects, driving the share price up too high, or overreact negatively to bad news, depressing the stock too much. These mispricings should correct once investor enthusiasm or pessimism reverts to the mean.

- Limits to arbitrage - In an efficient market, arbitrageurs would buy undervalued stocks and short sell overvalued ones, correcting pricing errors. But arbitrage has risks and costs that limit its force in correcting mispricings.

- Imperfect or asymmetric information - Investors do not all have the same information. Some trade based on incomplete data or suffer from behavioral biases. Insiders may profit from having superior access to information.

- Irrational exuberance - At market peaks, investor enthusiasm can lift stock prices far beyond reason. Likewise, at market troughs, fear and panic can depress prices excessively.

The gap between price and value presents an opportunity for savvy investors to buy underpriced stocks and sell or avoid overpriced ones. Value investors look for shares trading substantially below their intrinsic worth.

Examining company valuation metrics

Here are some key metrics to analyse when valuing Indian companies and their stocks:

- Price-to-earnings ratio: The P/E ratio compares a stock price to the company's annual earnings per share. Lower P/E stocks are considered undervalued compared to peers with higher P/E ratios. The average P/E ratio can vary significantly by sector and industry.

- Earnings per share: EPS measures a company's net profit allocated on a per share basis. Growing EPS generally indicates improving business performance. Investors should look for steady EPS growth over time.

- Return on equity: ROE measures a firm's profitability relative to its shareholders' equity. ROE reflects how well the company uses investors' capital to generate profits. A higher ROE indicates greater efficiency.

- Price to book value: The price-to-book (P/B) ratio compares the company's current share price to its book value per share. Book value equals assets minus liabilities. A low P/B may signal an undervalued stock.

- Cash flow: Analysing metrics like free cash flow yield or operating cash flow gives insight into how much excess cash the company generates after running the business. Cash flow fuels expansion, acquisitions, dividends, and stock buybacks.

- Industry metrics: Compare companies to sector and industry averages and medians to gauge their relative valuation. Firms trading at significant discounts to peers may be good value plays.

- Historical multiples: Track how valuation metrics have changed over time and versus historical averages for clues to over or undervaluation. Reversion to the mean is common.

- Forecast drivers: Make assumptions and projections about key value drivers like sales growth, margins, capex needs and capital structure. Model how forecast changes impact intrinsic value.

Valuation methods

- Discounted cash flow analysis: Projects future free cash flows and discounts them back to the present to estimate intrinsic value. Sensitive to assumptions and forecasts.

- Comparable trading multiples: Compares ratios like P/E, P/B and EV/EBITDA to peer companies to gauge relative valuation. Depends heavily on choosing suitable peers.

- Precedent transactions: Analyses valuation multiples paid in recent acquisitions of similar companies. Can provide valuation floor, as strategic buyers often pay premiums.

- Leveraged buyout analysis: Models a hypothetical leveraged buyout purchase price based on reasonable leverage and return assumptions. Helps establish a baseline valuation.

- Historic valuation multiples: Looks at a company's own valuation levels over time to identify potential mispricings relative to history. Requires normalizing unusual periods.

No single method provides a perfect measure of intrinsic value. Investors should use multiple approaches and require a margin of safety when investing in the share market.

Special cases - Growth and cyclical stocks

For high growth companies like technology stocks, traditional valuation metrics often appear stretched. Investors are paying for the company's future potential rather than just near-term profits. Growth stock investors rely more on revenue growth, user metrics, market share gains and long runway. Cyclical stocks like materials and industrials see valuations expand and contract based on economic cycles. Earnings correlate strongly to GDP growth. Ratios appear elevated at cycle peaks and depressed at troughs when profitability normalizes.

Valuing IPOs and unprofitable companies

Newly public companies lack long trading histories. Pre-IPO private valuations serve as reference points. Revenue growth and user traction take priority over earnings. Unprofitable firms must demonstrate a viable path to profitability.

The bubble debate

Critics often allege that India's share market is experiencing a valuation bubble. The counter arguments cite India's positive fundamentals like demographics, growing middle class, reforms, maturing companies and under-penetration of products and services. While pockets of overvaluation likely exist, broad generalisations may be premature given the diversity of Indian stocks and sectors.

Technical factors like liquidity, retail investor participation and momentum can distort prices over short-to-medium periods. Nevertheless, over the long run, fundamentals win out and rational valuations prevail. Patience and discipline are rewarded most often.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

Diljit Dosanjh shares unseen footage from Amar Singh Chamkila, wishes Happy Baisakhi

Diljit Dosanjh shares unseen footage from Amar Singh Chamkila, wishes Happy Baisakhi Delhi Capitals vs Mumbai Indians IPL 2025 LIVE Streaming Details: When and where to watch DC vs MI match 29 live on TV, online?

Delhi Capitals vs Mumbai Indians IPL 2025 LIVE Streaming Details: When and where to watch DC vs MI match 29 live on TV, online? DC vs MI IPL 2025 Dream11 prediction: Fantasy cricket tips, probable playing XIs, team news, injury updates for Delhi Capitals vs Mumbai Indians

DC vs MI IPL 2025 Dream11 prediction: Fantasy cricket tips, probable playing XIs, team news, injury updates for Delhi Capitals vs Mumbai Indians Viral video: 'Human Elephant' dances with the crowd to ‘Bing Bing Boo’, netizens appreciate creativity

Viral video: 'Human Elephant' dances with the crowd to ‘Bing Bing Boo’, netizens appreciate creativity Meet man who helped Mukesh Ambani’s son Anant Ambani lose 108 kilos, he charges Rs...

Meet man who helped Mukesh Ambani’s son Anant Ambani lose 108 kilos, he charges Rs... Supreme Court का ऐतिहासिक फैसला, पहली बार तय की राष्ट्रपति के लिए डेडलाइन, 5 पॉइंट्स में जानें सबकुछ

Supreme Court का ऐतिहासिक फैसला, पहली बार तय की राष्ट्रपति के लिए डेडलाइन, 5 पॉइंट्स में जानें सबकुछ Travishek ने असंभव को संभव कर दिया, चेज किया आईपीएल का दूसरा सबसे बड़ा स्कोर; बताया किसे कहते हैं नए जमाने का टी20

Travishek ने असंभव को संभव कर दिया, चेज किया आईपीएल का दूसरा सबसे बड़ा स्कोर; बताया किसे कहते हैं नए जमाने का टी20 कौन हैं Chanchal Mata, बॉलीवुड एक्ट्रेस जैसी खूबसूरत है ये अघोरी साध्वी, खाली हाथों से लगा देती हैं हवन में आग

कौन हैं Chanchal Mata, बॉलीवुड एक्ट्रेस जैसी खूबसूरत है ये अघोरी साध्वी, खाली हाथों से लगा देती हैं हवन में आग Viral News in Hindi: 60 साल के पाकिस्तानी चचा के प्यार में दीवानी हुई 18 साल की छोरी, बोली- हमें कबूल है

Viral News in Hindi: 60 साल के पाकिस्तानी चचा के प्यार में दीवानी हुई 18 साल की छोरी, बोली- हमें कबूल है UP के चीफ सेक्रेटरी और DGP से ज्यादा अमीर हैं DM और SP, जानिए कौन उत्तर प्रदेश का सबसे अमीर अधिकारी?

UP के चीफ सेक्रेटरी और DGP से ज्यादा अमीर हैं DM और SP, जानिए कौन उत्तर प्रदेश का सबसे अमीर अधिकारी? Delhi Capitals vs Mumbai Indians IPL 2025 LIVE Streaming Details: When and where to watch DC vs MI match 29 live on TV, online?

Delhi Capitals vs Mumbai Indians IPL 2025 LIVE Streaming Details: When and where to watch DC vs MI match 29 live on TV, online? DC vs MI IPL 2025 Dream11 prediction: Fantasy cricket tips, probable playing XIs, team news, injury updates for Delhi Capitals vs Mumbai Indians

DC vs MI IPL 2025 Dream11 prediction: Fantasy cricket tips, probable playing XIs, team news, injury updates for Delhi Capitals vs Mumbai Indians SRH vs PBKS, IPL 2025: Abhishek Sharma smashes record-breaking 141 as Sunrisers Hyderabad beat Punjab Kings by 8 wickets

SRH vs PBKS, IPL 2025: Abhishek Sharma smashes record-breaking 141 as Sunrisers Hyderabad beat Punjab Kings by 8 wickets SRH vs PBKS: Abhishek Sharma pulls out unique celebration after blasting 40-ball IPL century

SRH vs PBKS: Abhishek Sharma pulls out unique celebration after blasting 40-ball IPL century 'Hype thi, par khoda pahaad nikli chuhiya': Navjot Sidhu roasts MS Dhoni's captaincy return during CSK vs KKR IPL 2025 match

'Hype thi, par khoda pahaad nikli chuhiya': Navjot Sidhu roasts MS Dhoni's captaincy return during CSK vs KKR IPL 2025 match Delhi Rain: Thunderstorms And Rain Bring Long-Awaited Relief To NCR After Days Of Scorching Heat

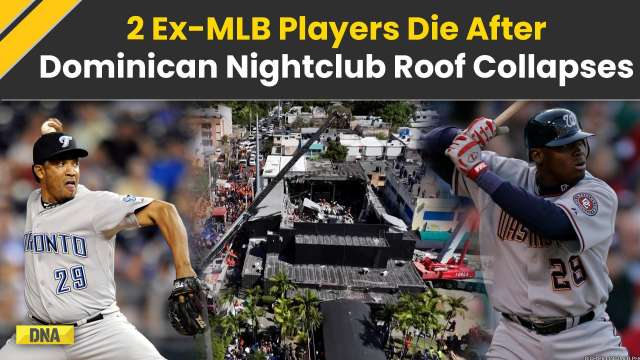

Delhi Rain: Thunderstorms And Rain Bring Long-Awaited Relief To NCR After Days Of Scorching Heat Dominican Republic Nightclub Collapse: Former MLB Players Octavio Dotel & Tony Blanco Among Deceased

Dominican Republic Nightclub Collapse: Former MLB Players Octavio Dotel & Tony Blanco Among Deceased Trump Tariffs: How Much Money Will the US Make From Tariffs? President Donald Trump Reveals

Trump Tariffs: How Much Money Will the US Make From Tariffs? President Donald Trump Reveals Trump Tariffs: US Slaps 104% Tariff On China After Beijing Misses President Trump's Deadline

Trump Tariffs: US Slaps 104% Tariff On China After Beijing Misses President Trump's Deadline Pawan Kalyan Shares Son Mark Shankar’s Health Update Injured In Singapore School Fire Incident

Pawan Kalyan Shares Son Mark Shankar’s Health Update Injured In Singapore School Fire Incident Meet Delhi billionaire, started company as bottler, became liquor baron with brands like Magic Moments, 8PM Whisky; his net worth is Rs...

Meet Delhi billionaire, started company as bottler, became liquor baron with brands like Magic Moments, 8PM Whisky; his net worth is Rs... Meet man, sole billionaire of Nepal, known as 'Noodle King,' has THIS connection to India

Meet man, sole billionaire of Nepal, known as 'Noodle King,' has THIS connection to India Meet the owner of Rosy Blue, one of world's top diamond companies, close relative of Mukesh Ambani, Nita Ambani, Anant Ambani, Akash Ambani

Meet the owner of Rosy Blue, one of world's top diamond companies, close relative of Mukesh Ambani, Nita Ambani, Anant Ambani, Akash Ambani Mukesh Ambani's Reliance Industries increases stakes in shipbuilding industry, invests in THIS company

Mukesh Ambani's Reliance Industries increases stakes in shipbuilding industry, invests in THIS company When Mukesh Ambani declared who is his boss in real life, hint it's another Ambani but not Nita Ambani, Anant Ambani, Akash Ambani

When Mukesh Ambani declared who is his boss in real life, hint it's another Ambani but not Nita Ambani, Anant Ambani, Akash Ambani Step inside Mammootty, Dulquer Salmaan’s stunning Rs 4 crore Kochi villa by lake

Step inside Mammootty, Dulquer Salmaan’s stunning Rs 4 crore Kochi villa by lake Meet Celebrity MasterChef winner Gaurav Khanna's wife Akanksha Chamola

Meet Celebrity MasterChef winner Gaurav Khanna's wife Akanksha Chamola Is Wamiqa Gabbi the new Preity Zinta: Bubbly actress set for Bhool Chuk Maaf release

Is Wamiqa Gabbi the new Preity Zinta: Bubbly actress set for Bhool Chuk Maaf release In pics: Meet Lalita Dsilva, childhood nanny of Anant Ambani, Taimur and Jeh Baba, she is also a pediatric nurse

In pics: Meet Lalita Dsilva, childhood nanny of Anant Ambani, Taimur and Jeh Baba, she is also a pediatric nurse Meet Chef Vikas Khanna, Harvard University's Person of the Year

Meet Chef Vikas Khanna, Harvard University's Person of the Year  88-year-old wife accuses 91-year-old husband of extra-marital affairs, then THIS happened...

88-year-old wife accuses 91-year-old husband of extra-marital affairs, then THIS happened... What is controversy over statue of DOG near memorial of Shivaji Maharaj at Raigad Fort?

What is controversy over statue of DOG near memorial of Shivaji Maharaj at Raigad Fort?  Did West Bengal CM Mamata Banerjee protect, encourage anti-Hindu violence? This is what BJP said

Did West Bengal CM Mamata Banerjee protect, encourage anti-Hindu violence? This is what BJP said Inside luxurious business jet Gulfstream, that brought 26/11 Mumbai attack plotter Tahawwur Rana to India

Inside luxurious business jet Gulfstream, that brought 26/11 Mumbai attack plotter Tahawwur Rana to India Delhi CM Rekha Gupta sees man throw 'roti' at cow on busy road, approaches him and does this

Delhi CM Rekha Gupta sees man throw 'roti' at cow on busy road, approaches him and does this Meet man who used to sleep with beggars, failed class 12, cracked UPSC with AIR....

Meet man who used to sleep with beggars, failed class 12, cracked UPSC with AIR.... Meet man who secured placement package of whopping Rs 1.03 crore per annum, not from IIT, IIM, NIT; he is from...

Meet man who secured placement package of whopping Rs 1.03 crore per annum, not from IIT, IIM, NIT; he is from... Meet man who scored 100 percentile in JEE Mains with rank 14, then cleared JEE Advanced with rank 2, later went to Berkeley for…

Meet man who scored 100 percentile in JEE Mains with rank 14, then cleared JEE Advanced with rank 2, later went to Berkeley for… Meet woman who studied Economics in London, cleared UPSC exam on 3rd attempt, later married another IAS officer, her AIR was...

Meet woman who studied Economics in London, cleared UPSC exam on 3rd attempt, later married another IAS officer, her AIR was... Meet woman who used her father-in-law's idea to build spice empire after her husband lost his job, now has hundreds of...

Meet woman who used her father-in-law's idea to build spice empire after her husband lost his job, now has hundreds of...

)